Mastering the 3-Statement Financial Model: essential insights for software companies

In-depth strategic guidance to help software founders and investors leverage financial modeling effectively.

Introduction: seeing beyond numbers

In venture capital and saas world, the 3-statement financial model isn’t just about crunching numbers—it’s your strategic blueprint. Think of it as an X-ray that reveals the strengths, weaknesses, and growth potential of your SaaS company. With recurring revenue streams, deferred income recognition, low incremental costs, and significant upfront investments, SaaS companies especially need precise financial modeling.

Using the 3 statement SaaS financial model I've provided below, I'll break down each key financial statement (Income Statement, Balance Sheet, Cash Flow Statement) with practical insights, actionable tips, and critical red flags for founders and investors.

📈 Income Statement: driving growth first, profits later

Revenue dynamics:

Revenue expands from $60,000 in Year 1 to $300,000 by Year 4, mainly via subscription fees;

Refunds (around 5%) indirectly signal customer satisfaction and churn risk. Rising refunds? Time to re-examine your product-market fit.

Gross margins:

Gross margins consistently above 80% indicate strong scalability. Margins dropping below 70% suggest you may need to improve infrastructure efficiency or reconsider your pricing.

Operating expenses as strategic investments:

Expenses (R&D, Sales & Marketing, General & Administrative) grow proportionally with revenue, deliberately delaying profitability to capture market share.

Bottom line:

Initial years typically show deliberate losses, aligning with the SaaS strategy to prioritize rapid growth.

⚡️ Actionable tip:

Regularly measure CAC payback. If exceeding 24 months or Sales & Marketing costs are over 50% of revenue, reconsider your scalability approach.

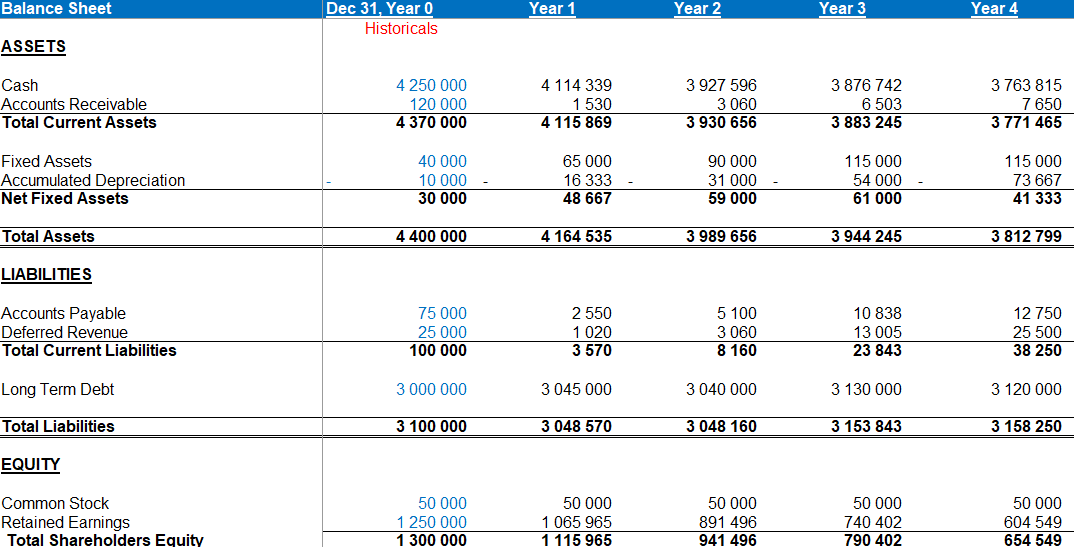

📊 Balance Sheet: managing miquidity and financial flexibility

Cash Burn and runway management:

Starting with $4.25 million equity, cash steadily decreases due to operating losses. Frequent runway updates are crucial for effective fundraising.

Working capital management:

Accounts Receivable growth (from $1,530 in Year 1 to $7,650 in Year 4) demands close monitoring. Delayed collections can strain liquidity;

Deferred Revenue growth signals trust and predictable future earnings. Rapid growth without corresponding ARR increases may hint at aggressive billing practices rather than real growth.

Capital investments:

Capex in software and infrastructure is capitalized and depreciated over 3–5 years, reflecting disciplined financial management.

Equity vs. debt:

Exclusively equity-financed to maintain financial agility. Monitor dilution risks carefully.

🚩 Red flag:

Sharp deferred revenue growth paired with stagnant ARR suggests aggressive pre-billing, not actual expansion.

⚡️ Actionable tip:

Regularly perform runway analyses (Base, Slowdown, Ramp scenarios). Clearly map future funding timelines and required amounts.

💸 Cash Flow Statement: Safeguarding Liquidity

Operating Cash Flows:

Initial negative cash flows are normal for SaaS firms. These are offset somewhat by depreciation and deferred revenue.

Investing activities:

Consistent capex investments are essential for maintaining scalable infrastructure.

Financing activities:

Equity funding rounds strategically align with key milestones such as product releases and revenue goals.

⚡️ Actionable tip:

Chart monthly cash flows against fundraising events. Maintain a 4-6 month buffer to protect valuation and strengthen your negotiation position.

🔄 Interconnectedness: the model as a strategic whole

A robust 3-statement model isn't just linked—it’s strategically interwoven:

Capex: immediately impacts cash flow, increases assets, and affects future profitability via depreciation;

Deferred revenue: enhances immediate liquidity but delays revenue recognition;

Working capital: subtly influences liquidity without directly changing profitability.

⚡️ Actionable tip:

Stress-test working capital assumptions regularly (e.g., adding a 10-day delay to receivables) to visualize potential liquidity impacts immediately.

🚀 Strategic importance for founders and investors

For founders:

Keep your financial model updated. Use an "actual vs. forecast" dashboard for board meetings. Clearly align funding rounds with operational milestones.

For investors:

Independently reconstruct financial models to rigorously validate key assumptions. Identify overly optimistic forecasts or underestimated costs early for proactive management.

✅ Conclusion: build, analyze, optimize

Don't just download this model—actively engage with it. Experiment, stress-test scenarios, visualize your runway, and deepen your strategic understanding.

Next steps:

Refine your model with scenario analyses (base, best, worst case scenario);

Clearly incorporate fundraising strategies (equity rounds, SAFE notes, dilution impacts);

Track key Saas metrics (CAC, LTV, Churn, Gross Margin, Net Revenue Retention);

Visualize clearly—chart ARR, burn rate, and cash runway.

👉 Download your 3-Statement SaaS Financial Model here

Need help optimizing your financial model or strategy? Feel free to reach out—I’m here to assist you.

That's a wrap up! Thank you for reading this article! What specific topics in VC or regarding software would you be interested in? Feel free to share your feedback 🌐 and give a ❤️ if you enjoyed it!